An Analysis Of Company

The company analysis would discuss the financial status of the whole company of Abercrombie and Fitch, this would include all brands within the company. This has not involved Hollister as the brand has been gaining an increase within the market and is currently doing well and better with increase of profits, sales and stocks.

Company financial analysis

The current stock levels of Abercrombie & Fitch have recently decreased by $20.98, -1.41%, which is the current status of 2019, and the highest was $21.52 an increase 2.94% which happened on the 10th Of February (Investors Network, 20thFebruary 2019). The stock levels allow to see the performance within the company for the shareholders. This also shows within the current trading the company is facing low stock trade since 2019. These showing investors, they won’t be gaining any money, compared with the average competitor earning 1.1% more. As for the brand their share prices are similar as they would not be gaining any shares within the ownership and it means they won’t be gaining any shared for the last two months over their products.

The Gross profit Margin for Abercrombie & Fitch has increased by 54.22% as of 2018, however, that was an increase of the year before when performance was the lowest of goods sales since 2014. Which show there has been a decrease on customer demands as product pricing have increased to double up with competitor's pricing (The Wall Street Journal, 2018).

In addition, as of 2018, A&F have suffered from a revenue decrease 3% or 4% year by year. The revenue decline suggests the profits within the company are low and have not gained enough causing the brand to struggle with stocks/ investors and sales. Causing the value of the company within eyes of other potential business assets have been lowered. If the decrease continues it could cause more potential problems for the company (Seeking alpha, 2018).

Abercrombie & Fitch current level of debt is equal to 25.1%, the company is majority made up of debts by $298.9 million. The company has only $592.0 million of short-term investments which would not help. Furthermore, the company has not taken a measure as of 2012 the debts have started. Which has also caused the new worth of the company to become lower. If A&F don’t pay any debts, then there would be 7.9x more interest causing the company to suffer more (Simply wall St 2018).

Company productivity analysis

The productivity rate shows the economic output associated with the level of input, which would also allow an indication if the company is getting the most out of the staff. As seen Abercrombie & Fitch performance is low showing as stock and profit margins are low the company is suffering. As payment to staff is still needed the number of current stores does not help the brand as it means more stuff in the store and having more quality controls and processing, as well as international employees. This also limits the encouragement of employees, as if a company is low there is less encouragement for the most out of staff which affects the brand. But if money is coming in then it changes behaviour as it would be making a more effective employee which can affect success rates.

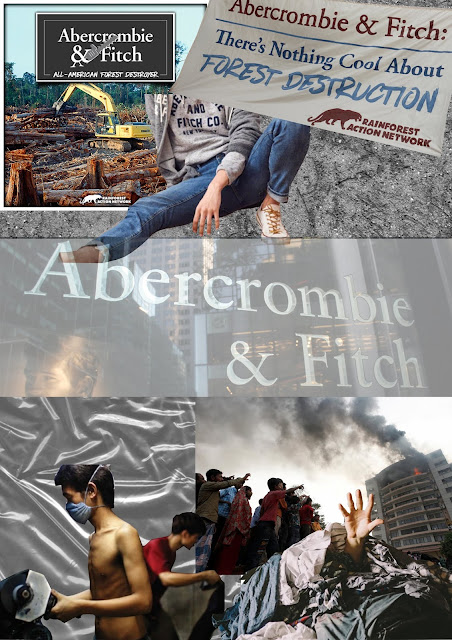

As there has been controversies on employees’ responses to the brand which has affected who wants to work there or who doesn’t. Currently from the new branding the company is more ‘inconclusive and diverse’.

References

Investors Network (2019 20thFebruary) Abercrombie & Fitch Co. Retrieved from: https://www.investornetwork.com/company/C-DD0996AB6473B?utm_campaign=in-migration&utm_source=oar

The wall street journal, (2018) Abercrombie & Fitch Co retrieved from: https://quotes.wsj.com/ANF/financials/annual/income-statement

Seeking Alpha (2018, November 27th) Can Abercrombie & Fitch Survive A Revenue Decline? Retrieved from: https://seekingalpha.com/article/4224866-can-abercrombie-and-fitch-survive-revenue-decline

Simply Wall Street (2018, august 30th) How financially strong is Abercrombie & Fitch Co. Retrieved from: https://simplywall.st/stocks/us/retail/nyse-anf/abercrombie-fitch/news/how-financially-strong-is-abercrombie-fitch-co-nyseanf/

Comments

Post a Comment